Stats & Links: FC Bayern, a member of the rich kids club

What is the Deloitte Football Money League?

Since 1998 the accounting company Deloitte has delighted financially inclined football fans at the start of every year with their ranking list of the 20 football clubs with the highest turnover, the Deloitte Football Money League. The figures relate to the previous season, and all income is divided up into three categories. The three categories are matchday (ticket revenue etc.), broadcast (such as television rights), and commercial (covering all sponsorship deals and so on).

Deloitte does not incorporate income from transfers. As a result, the figures differ from those in the financial results round-up, for example, and the financial potential of “selling clubs” is somewhat skewed. Last season, for example, Zenit St Petersburg (+€82 million) and Benfica (+€78 million) generated a positive net spend that isn’t to be underestimated, which would have catapulted those teams from the top 30 into the top 20 had those figures been counted. However, since calculating the balance of transfer fees, which are amortized over the length of a player’s contract, is hardly a walk in the park due to staggered payments, we’ll leave it at that naïve miscalculation and trust the expertise of the people at Deloitte.

The richest of the rich

Leading the current Deloitte list is Manchester United (€676 million) ahead of Real Madrid (€675 million) and FC Barcelona (€648 million). The total turnover of the top 20 teams rose by 6% in comparison to last year.

That growth comes mostly from the broadcasting category, which for the first time is now the clubs’ main income source. While the previous season saw commercial (43%) ahead of broadcasting (39%), the numbers have flipped in favour of broadcasting (45%) as opposed to commercial (38%).

The cause for that, above all, is the new Premier League TV deal which has boosted the English clubs in the Deloitte list. Ten of the top 20 clubs play in the Premier League (14 of the top 30). Clubs like West Ham (€213 million) and Southampton (€212 million), for example, find themselves in positions 17 and 18 respectively, ahead of regular Champions League competitors like Napoli (€201 million), Lyon (€198 million), AC Milan (€192 million), or AS Roma (€172 million).

From next year the German clubs will be able to profit from the new Bundesliga TV deal and reduce the distance in the financial tables. Growth of 80% is expected in comparison to the current Bundesliga TV contract.

FC Bayern’s position

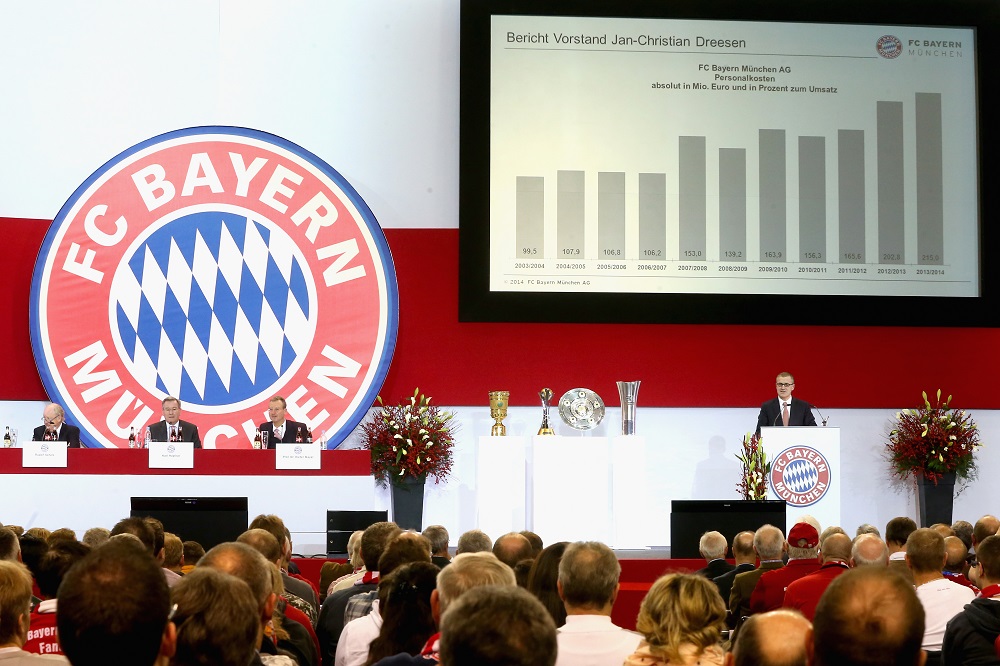

Though Bayern’s income dropped slightly from €592 million in the previous season to €588 million, Bayern remains, as in the last ten years, among the five teams with the highest turnover in the world. From a financial perspective, it’s not since the treble year that Bayern has landed in the phalanx of Europe’s super clubs, but rather is a long-time member of the rich kids club.

Jan-Christian Dreesen must get a lot of envious looks cast his way, above all for Bayern’s income in the commercial category, as no football club in the world brings in as much money in that category as FC Bayern (€343 million). Not even Manchester United at the top of the class (€325 million) or PSG’s creative tinkerers (€274 million).

There is one catch to the whole thing though, because with the commercial part contributing to 58% of its total turnover, FC Bayern is simultaneously more dependent on one area of income than almost any other club. The far-and-away leader of the dependence rankings is, by the way, Leicester City, who believe it or not obtained 82% of all of its income from one of the three sources, bringing in €222 million out of €271 million from broadcasting alone.

FC Bayern has already closed sponsorship deals from every possible source, as evidenced by the criticism for the deal with the Hamad International Airport.

The matchday area, meanwhile, has stagnated around the €100 million mark with a share of around 17%. The €4 million decrease in total income in comparison to last year came entirely from the matchday section, with a lower number of cup games hosted. With the moderate Bundesliga ticket prices and the fact that the Allianz Arena is constantly sold out, big increases in income here will be hard to come by. Sporting success, i.e. further progress in cup competitions, is the only chance of increasing income in this category.

(Image: Alexander Hassenstein/Bongarts/Getty Images)

That leaves the broadcasting section then. Currently at €147 million, the final section makes up for the final 25% of Bayern’s total income.

As already mentioned, from this season onwards the new and clearly improved Bundesliga TV marketing contract will take hold. It won’t, however, be able to close the gap to the top earners in that area, and so these are the challenges that remain for FC Bayern:

Because of the Champions League reform next season, the relative incomes from the Champions League TV pool will decrease for Bayern, since there will now be four Bundesliga teams guaranteed to make the group stages.

In order to further increase the income from the Bundesliga rights beyond the current period, the Bundesliga product must be (remain/become) attractive. Here a movement to the “French” model would be a disadvantage for Bayern for two reasons. International competitive standing suffers both from a sporting point of view as well as financially with one team dominating the league.

At the end of the day, higher income from the broadcasting section (just like with the matchday section) will come from the fans’ pockets. Regarding both broadcasting and matchday, there are of course limits to the costs per fan.

In contrast to the capacity of the Allianz Arena, the number of viewers watching with (digital) devices could be further increased. FC Bayern’s financial competitive standing could, then, depend in the long-term on whether or not millions of willing customers around the globe can be successfully converted to fans of the Bundesliga product.

Currently not such an easy task.

Links of the week

Round of 16 Fan Preview: Bayern Munich | Michael Böck | Breaking The Lines

Fridolina Rolfö interview: Someday comes today for Bayern’s super Swede | Christian Brookes | Beats & Rhymes FC

In appreciation of Joshua Kimmich, Germany’s Footballer of the Year | Nebojša Marković | Medium

Reintroducing Thomas Müller as the “Room-Maker” | Travis Timmons | Bundesliga Fanatic

Franck Ribéry: the Galatasaray diaries | James Kelly | These Football Times

Revealed! The 20 best free-kick takers in European football | Amit Katwala | FourFourTwo

Foreign leagues profit from Premier League wealth. | EightyFivePoints

Bayern win big in January window, Dortmund will struggle to rebuild | Raphael Honigstein | ESPN FC

Current Miasanrot-articles

Episode 18 – Mainz and Paderborn | Susie & Chris

Who will be FC Bayern’s coach? | Justin | Dennis

3 Things We Noticed: SC Paderborn – FC Bayern 0-6 (0-3) | Felix | Dennis

3 Things We Noticed: FSV Mainz 05 – FC Bayern 0-2 (0-2) | Christopher | Sam

Kick it like Kurt – the Kurt Landauer Foundation | Felix | Sam & Bettina

Current statistics and visualizations

You are currently viewing a placeholder content from X. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.